Are there alternatives to an OIC?, interview with Springer Jones, Enrolled Agent

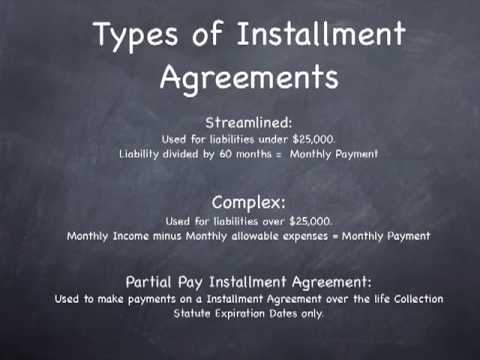

There are numerous other solutions. For example, Installment Agreements, Bankruptcy, Innocent Spouse Relief, Penalty Abatement, Currently Uncollectible Status, and Statute of Limitations review. Although some changes in lifestyle may be appropriate, there is always a way to resolve a tax problem.

http://www.getirshelptoday.com

[

go to Youtube.com

]

There are numerous other solutions. For example, Installment Agreements, Bankruptcy, Innocent Spouse Relief, Penalty Abatement, Currently Uncollectible Status, and Statute of Limitations review. Although some changes in lifestyle may be appropriate, there is always a way to resolve a tax problem.

http://www.getirshelptoday.com

[

go to Youtube.com

]

Time

: 1 min

38

Added

: 30/12/08 05:33

Send with Gmail

Videos

(24)

|

Blog posts

(2)

Will an OIC show on your credit report?, interview with Springer Jones, Enrolled Agent

No. Unlike a bankruptcy or credit card charge off, an Offer in Compromise does not get reported to the credit reporting agencies. An Offer in Compromise will not negatively affect your credit score. However, ignoring the problem will cause the IRS to file a notice of federal Tax Lien, with your county recorder, which WILL show up on your credit report.

http://www.getirshelptoday.com

[

go to Youtube.com

]

No. Unlike a bankruptcy or credit card charge off, an Offer in Compromise does not get reported to the credit reporting agencies. An Offer in Compromise will not negatively affect your credit score. However, ignoring the problem will cause the IRS to file a notice of federal Tax Lien, with your county recorder, which WILL show up on your credit report.

http://www.getirshelptoday.com

[

go to Youtube.com

]

Time

: 1 min

59

Added

: 30/12/08 06:10

Send with Gmail

Tax Consultant CAN Help You with Your IRS Tax Problems (888) 940-1040

If you are receiving letters or phone calls from the IRS or if they have place liens or levies, Demetriou, Montano, and Associates can help you put together a workable solution with the IRS. They used to be tax agents so they know how to talk to their ex-associates to get you the best deal possible. Visit their website for more information at www.taxrepair.com or call NOW (888) 940-1040.

[

go to Youtube.com

]

If you are receiving letters or phone calls from the IRS or if they have place liens or levies, Demetriou, Montano, and Associates can help you put together a workable solution with the IRS. They used to be tax agents so they know how to talk to their ex-associates to get you the best deal possible. Visit their website for more information at www.taxrepair.com or call NOW (888) 940-1040.

[

go to Youtube.com

]

Time

: 3 min

42

Added

: 21/03/09 03:03

Send with Gmail

How long does an OIC take?, interview with Springer Jones, Enrolled Agent

Generally, you must allow 6-12 months for an Offer in Compromise. If your case gets rejected and is taken to Appeals, it could take longer. But, no matter how long it takes, the IRS can often suspend all collection activities.

http://www.getirshelptoday.com

[

go to Youtube.com

]

Generally, you must allow 6-12 months for an Offer in Compromise. If your case gets rejected and is taken to Appeals, it could take longer. But, no matter how long it takes, the IRS can often suspend all collection activities.

http://www.getirshelptoday.com

[

go to Youtube.com

]

Time

: 3 min

17

Added

: 30/12/08 07:11

Send with Gmail

Settling IRS Tax Debt

www.bills.com You must be in compliance with the IRS before you can apply for tax relief. In order to be in compliance, you must file the last six years worth of returns. From there, a tax settlement firm will negotiate with the IRS to create a five-year installment agreement. If you are unable to pay the tax owed, they can negotiate for an offer in compromise to pay the debt and remove tax liens from your record.

[

go to Youtube.com

]

www.bills.com You must be in compliance with the IRS before you can apply for tax relief. In order to be in compliance, you must file the last six years worth of returns. From there, a tax settlement firm will negotiate with the IRS to create a five-year installment agreement. If you are unable to pay the tax owed, they can negotiate for an offer in compromise to pay the debt and remove tax liens from your record.

[

go to Youtube.com

]

Time

: 1 min

58

Added

: 10/09/09 11:57

Send with Gmail

Is an Offer in Compromise Public Information?, interview with Springer Jones, Enrolled Agent

Yes, accepted OICs are public record for one year. And you can inspect OICs that have been approved in your district within the past year for an idea of what the IRS may accept in your case.

http://www.getirshelptoday.com

[

go to Youtube.com

]

Yes, accepted OICs are public record for one year. And you can inspect OICs that have been approved in your district within the past year for an idea of what the IRS may accept in your case.

http://www.getirshelptoday.com

[

go to Youtube.com

]

Time

: 1 min

21

Added

: 30/12/08 04:56

Send with Gmail

IRS tax debt payment plan

getirshelpvideos.com - When you cannot afford to pay your IRS tax debt in one lump sum, there is a solution. Tax Attorney Darrin T. Mish explains how to get an IRS Installment Agreement even if the IRS has already rejected it before.

[

go to Youtube.com

]

getirshelpvideos.com - When you cannot afford to pay your IRS tax debt in one lump sum, there is a solution. Tax Attorney Darrin T. Mish explains how to get an IRS Installment Agreement even if the IRS has already rejected it before.

[

go to Youtube.com

]

Time

: 5 min

17

Added

: 06/08/09 20:33

Send with Gmail

Samuel Landis-Tax Attorney IRS Resolution Interview (Important Things You Want to Know)

An interview with tax attorney Samuel Landis regarding important issues in resolving IRS problems. Topics include: how to choose the right representative and how to avoid making mistakes in dealing with the IRS. For more information please contact: slandis@scltaxlaw.com or (310)285-3999

[

go to Youtube.com

]

An interview with tax attorney Samuel Landis regarding important issues in resolving IRS problems. Topics include: how to choose the right representative and how to avoid making mistakes in dealing with the IRS. For more information please contact: slandis@scltaxlaw.com or (310)285-3999

[

go to Youtube.com

]

Time

: 7 min

31

Added

: 17/09/09 23:09

Send with Gmail

When does IRS tax debt expire?

getirshelpvideos.com - IRS debt can feel like a lifetime sentence. They say IRS problems don't solve themselves, but in some cases they can. Tax Attorney Darrin T. Mish explains how sometimes IRS problems just might solve themselves.

[

go to Youtube.com

]

getirshelpvideos.com - IRS debt can feel like a lifetime sentence. They say IRS problems don't solve themselves, but in some cases they can. Tax Attorney Darrin T. Mish explains how sometimes IRS problems just might solve themselves.

[

go to Youtube.com

]

Time

: 3 min

54

Added

: 30/06/09 20:46

Send with Gmail

How to get out of paying for former spouse's IRS tax debt

getirshelpvideos.com When a former spouse runs up a large IRS tax debt it's hard to find information about solving the problem. Tax Attorney Darrin T. Mish explains IRS Innocent Spouse and Equitable Relief in an easy to understand way.

[

go to Youtube.com

]

getirshelpvideos.com When a former spouse runs up a large IRS tax debt it's hard to find information about solving the problem. Tax Attorney Darrin T. Mish explains IRS Innocent Spouse and Equitable Relief in an easy to understand way.

[

go to Youtube.com

]

Time

: 4 min

54

Added

: 28/03/09 16:01

Send with Gmail

1 -

10

of

24

Videos

Page:

First

| <

Preceding

|

Next

>

0

|

1

|

2