IRS Tax Debt Help

We Can Provide IRS Tax Debt Help Immediately. You Will Only Pay A Fraction Of What You Owe...Guaranteed! Our Proposals Are FREE! freetaxrelief.info Let Us Provide IRS Tax Debt Help Right Now...It Is FREE! We Can Remove All Garnishes And Liens Right Away.

[

go to Youtube.com

]

We Can Provide IRS Tax Debt Help Immediately. You Will Only Pay A Fraction Of What You Owe...Guaranteed! Our Proposals Are FREE! freetaxrelief.info Let Us Provide IRS Tax Debt Help Right Now...It Is FREE! We Can Remove All Garnishes And Liens Right Away.

[

go to Youtube.com

]

Time

: 0 min

50

Added

: 25/08/09 13:08

Send with Gmail

Videos

(42)

|

Blog posts

(11)

Settling IRS Tax Debt

www.bills.com You must be in compliance with the IRS before you can apply for tax relief. In order to be in compliance, you must file the last six years worth of returns. From there, a tax settlement firm will negotiate with the IRS to create a five-year installment agreement. If you are unable to pay the tax owed, they can negotiate for an offer in compromise to pay the debt and remove tax liens from your record.

[

go to Youtube.com

]

www.bills.com You must be in compliance with the IRS before you can apply for tax relief. In order to be in compliance, you must file the last six years worth of returns. From there, a tax settlement firm will negotiate with the IRS to create a five-year installment agreement. If you are unable to pay the tax owed, they can negotiate for an offer in compromise to pay the debt and remove tax liens from your record.

[

go to Youtube.com

]

Time

: 1 min

58

Added

: 10/09/09 11:57

Send with Gmail

How long does an OIC take?, interview with Springer Jones, Enrolled Agent

Generally, you must allow 6-12 months for an Offer in Compromise. If your case gets rejected and is taken to Appeals, it could take longer. But, no matter how long it takes, the IRS can often suspend all collection activities.

http://www.getirshelptoday.com

[

go to Youtube.com

]

Generally, you must allow 6-12 months for an Offer in Compromise. If your case gets rejected and is taken to Appeals, it could take longer. But, no matter how long it takes, the IRS can often suspend all collection activities.

http://www.getirshelptoday.com

[

go to Youtube.com

]

Time

: 3 min

17

Added

: 30/12/08 07:11

Send with Gmail

Debt Relief Programs

www.youricw.com "Are you thinking about using a debt relief program, but not sure how to find a company that is reputable, honest, trustworthy, will save you money and won't rip you off?" We have complied some helpful information for you here, with a link to a comparison and review of three companies that provide debt relief programs.

[

go to Youtube.com

]

www.youricw.com "Are you thinking about using a debt relief program, but not sure how to find a company that is reputable, honest, trustworthy, will save you money and won't rip you off?" We have complied some helpful information for you here, with a link to a comparison and review of three companies that provide debt relief programs.

[

go to Youtube.com

]

Time

: 2 min

46

Added

: 10/09/09 19:27

Send with Gmail

IRS Debt Help - Filing Extension - Form 4868

IRSDebtHelpHQ.com - File for an extension of time to file your personal income tax return. It is important to note that an extension of time to file is not an extension of time to pay. If you have a balance due and don't pay it by April 15th, you will still accrue penalties and interest on that balance due.

[

go to Youtube.com

]

IRSDebtHelpHQ.com - File for an extension of time to file your personal income tax return. It is important to note that an extension of time to file is not an extension of time to pay. If you have a balance due and don't pay it by April 15th, you will still accrue penalties and interest on that balance due.

[

go to Youtube.com

]

Time

: 6 min

54

Added

: 18/03/09 15:40

Send with Gmail

IRS Debt Help Now

http://www.IRSDebtHelpHQ.com Get the IRS debt help that you need now. Professional tax resolution can help you settle your IRS tax debt for less than what you owe and obtain penalty relief.

[

go to Youtube.com

]

http://www.IRSDebtHelpHQ.com Get the IRS debt help that you need now. Professional tax resolution can help you settle your IRS tax debt for less than what you owe and obtain penalty relief.

[

go to Youtube.com

]

Time

: 0 min

31

Added

: 26/12/08 06:33

Send with Gmail

Is an Offer in Compromise Public Information?, interview with Springer Jones, Enrolled Agent

Yes, accepted OICs are public record for one year. And you can inspect OICs that have been approved in your district within the past year for an idea of what the IRS may accept in your case.

http://www.getirshelptoday.com

[

go to Youtube.com

]

Yes, accepted OICs are public record for one year. And you can inspect OICs that have been approved in your district within the past year for an idea of what the IRS may accept in your case.

http://www.getirshelptoday.com

[

go to Youtube.com

]

Time

: 1 min

21

Added

: 30/12/08 04:56

Send with Gmail

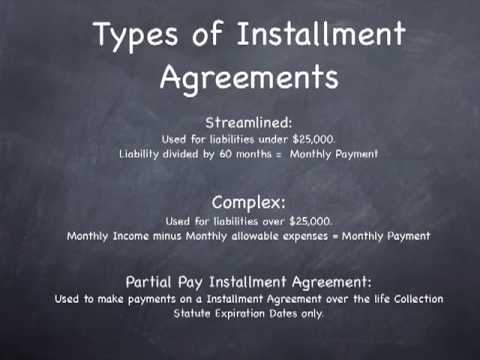

IRS tax debt payment plan

getirshelpvideos.com - When you cannot afford to pay your IRS tax debt in one lump sum, there is a solution. Tax Attorney Darrin T. Mish explains how to get an IRS Installment Agreement even if the IRS has already rejected it before.

[

go to Youtube.com

]

getirshelpvideos.com - When you cannot afford to pay your IRS tax debt in one lump sum, there is a solution. Tax Attorney Darrin T. Mish explains how to get an IRS Installment Agreement even if the IRS has already rejected it before.

[

go to Youtube.com

]

Time

: 5 min

17

Added

: 06/08/09 20:33

Send with Gmail

Eliminate IRS Debt

Taxation is voluntary! Don't be intimidated by the IRS! Learn your rights! Be free from IRS debt! Learn how you can eliminate your IRS forever!

[

go to Youtube.com

]

Taxation is voluntary! Don't be intimidated by the IRS! Learn your rights! Be free from IRS debt! Learn how you can eliminate your IRS forever!

[

go to Youtube.com

]

Time

: 1 min

02

Added

: 05/05/09 19:27

Send with Gmail

IRS Debt Help Now - Taxpayer Advocate Service

http://www.IRSDebtHelpHQ.com The IRS taxpayer advocate service can assist you with resolving issues that aren't fixed through normal IRS channels. Learn how to file Form 911, Request for Assistance.

[

go to Youtube.com

]

http://www.IRSDebtHelpHQ.com The IRS taxpayer advocate service can assist you with resolving issues that aren't fixed through normal IRS channels. Learn how to file Form 911, Request for Assistance.

[

go to Youtube.com

]

Time

: 9 min

17

Added

: 15/01/09 19:08

Send with Gmail

11 -

20

of

42

Videos

Page:

First

| <

Preceding

|

Next

>

0

|

1

|

2